Act reliably

Our Annual Report

In the corporate governance declaration (also known as the Corporate Governance Report), the Management Board and the Supervisory Board report on the principles of management and corporate governance for the last fiscal year in accordance with Sections 289f and 315d of the German Commercial Code (HGB) and Principle 23 of the German Corporate Governance Code (GCGC, in the current version published on April 28, 2022).

The declaration contains the Declaration of Conformity, information on corporate governance practices, a description of how the Management Board and Supervisory Board work and key corporate governance structures. The declaration is also available to the public on our website. Pursuant to Section 317 (2) (6) HGB, the disclosures pursuant to Sections 289f and 315d HGB are not included in the audit performed by the auditor of the annual financial statements.

In order for a company to be successful, its business model has to be accepted by all relevant stakeholder groups, from its customers through to civil society and the public, investors or business partners. Managing with integrity, the sustainability of business models and the extent to which a company is perceived as living up to its social responsibilities are playing an increasingly important role. This applies no less to the real estate sector.

Any misconduct by a company’s management also tends to result in the corporate governance regulations being tightened up, as was the case with the Financial Market Integrity Strengthening Act (FISG). Among other measures, the obligation to establish an appropriate and effective internal control system (ICS) as well as a corresponding risk management system (RMS) for listed stock corporations was introduced in a quest to strengthen trust in the German financial market.

This is why, here at Vonovia, the Management Board and the Supervisory Board see corporate governance as the responsible management and supervision of a company. The Management Board and the Supervisory Board have made a comprehensive commitment to the principles of corporate governance as set out in the German Corporate Governance Code.

These principles are the basis for the sustainable success of the company and therefore serve as guidelines for conduct in the company’s daily management and business. Good corporate governance strengthens the trust of our shareholders, business associates, customers, employees and the general public in Vonovia SE. It increases the company’s transparency and strengthens the credibility of our group of undertakings.

With balanced corporate governance, the Management Board and the Supervisory Board wish to safeguard Vonovia SE’s competitiveness, strengthen the trust of the capital market and the general public in the company and sustainably increase the company’s value. Corporate governance, acting in accordance with the principles of responsible management aimed at increasing the value of the business on a sustainable basis, is an essential requirement for the Vonovia Group, embracing all areas of the business.

As a major real estate company, we are aware of the particular significance of our entrepreneurial actions for society at large. Our corporate culture is founded on transparent reporting and corporate communications, on corporate governance aimed at the interests of all stakeholders, on fair and open dealings between the Management Board, the Supervisory Board and employees as well as on compliance with the law.

The Code of Conduct provides the ethical and legal framework within which we act and want to ensure our commercial success. The focus is on dealing fairly with each other but also in particular on dealing fairly with our customers, business partners and investors. The Code of Conduct specifies how we assume our ethical and legal responsibility as a company and is the expression of our company values.

The designation Vonovia comprises Vonovia SE and its Group companies. Vonovia is a European company (SE) in accordance with the German Stock Corporation Act (AktG), the SE Act and the SE Regulation. Its registered headquarters are in Bochum. It has three governing bodies: the Annual General Meeting, the Supervisory Board and the Management Board. The duties and authority of those bodies derive from the SE Regulation (SE-VO), the German Stock Corporation Act (AktG) and the Articles of Association. Shareholders, as the owners of the company, exercise their rights at the Annual General Meeting.

According to the two-tier governance system, Vonovia SE has a Management Board and a Supervisory Board. In the two-tier governance system, the management of business and the monitoring of business are strictly separated from each other, meaning that individuals cannot be members of both bodies at the same time. The duties and responsibilities of the bodies are clearly specified by law in the German Stock Corporation Act. In accordance with the governing laws, in particular the SE Regulation and the German SE Employee Participation Act (SEBG), the Supervisory Board is only made up of representatives of the shareholders. The highest representative body of the employees is the Group works council. An SE works council was also set up at the level of Vonovia SE.

The Management Board and Supervisory Board of a company listed in Germany are obliged by law (Section 161 of the German Stock Corporation Act) to report once a year on whether the officially published and relevant recommendations issued by the government commission German Corporate Governance Code, as valid at the date of the declaration, have been, and are being, complied with. Companies affected are also required to state which of the recommendations of the Code have not been, or will not be, applied and, if not, why. The most recent Declaration of Conformity is valid for at least the next five years and the Declarations of Conformity that are no longer valid can be found on the company’s website. If the auditor finds the Declaration of Conformity to be incorrect, the Supervisory Board is informed and this is also noted in the audit report.

The Management Board reports in its declaration, also on behalf of the Supervisory Board, on important aspects of corporate governance pursuant to Section 289f of the German Commercial Code (HGB) and Principle 23 of the German Corporate Governance Code (GCGC) 2022.

In March 2025, the Management Board and the Supervisory Board of Vonovia SE declared that, since the last Declaration of Conformity was issued on March 26, 2024, the company has complied with, and in future will comply with, all the recommendations of the Government Commission on the German Corporate Governance Code (Regierungskommission Deutscher Corporate Governance Kodex) as published by the German Federal Ministry of Justice in the official section of the Federal Gazette on June 27, 2022 (the “Code”), with the exception of the recommendation set out in G.13 sentence 2 of the Code:

G.13 sentence 2 of the Code specifies that, if post-contractual non-compete clauses apply, the severance payments shall be taken into account in the calculation of any compensation payments. Due to grandfathering rights, this recommendation has not yet been implemented in one case. In case of extensions of existing contracts or conclusions of new contracts the recommendation set out in G.13 sentence 2 of the Code will be complied with.

Shareholder Information: Shareholders can obtain full and timely information about our company on our website and can access current as well as historical company data. Among other information on its website, Vonovia regularly posts all financial reports, important information on the company’s governing bodies (including current resumes), its corporate governance documentation (declaration of conformity and governance-related guidelines and voluntary commitments), information requiring ad hoc disclosure and press releases. The company initiates and supports structured dialogue between its stakeholder groups, in particular employees, customers and shareholders of Vonovia (e.g., through customer satisfaction analyses and suitable formats, such as corporate governance roadshows, to involve the various stakeholder groups).

Directors’ Dealings: Information on directors’ dealings/managers’ transactions notifiable pursuant to Article 19 of the Market Abuse Regulation is published by Vonovia without delay in accordance with the Regulation and is made available on the company’s website, with information also being provided on the shares held by each member of the company’s executive bodies.

Financial Calendar: Shareholders and interested members of the financial community can use the regularly updated financial calendar on the website to obtain information on publication, conference and information dates, roadshows and the timing of the Annual General Meeting early on.

Annual General Meeting and Voting: The Annual General Meeting decides in particular on the appropriation of profit, the ratification of the acts of the members of the Management Board and of the Supervisory Board, the appointment of the external auditor, amendments to the Articles of Association as well as specific capital measures and intercompany agreements, and individually elects the shareholders’ representatives to the Supervisory Board.

Our shareholders can exercise their voting rights at the meeting or instruct a proxy of their choice or one of the proxies provided for that purpose by the company. Our shareholders are also able to submit a postal vote. The details regarding the postal voting procedure are in the respective shareholder’s invitation to the Annual General Meeting.

The entire documentation for the Annual General Meeting and opportunities to authorize, and issue instructions to, the company’s proxies as well as to submit a postal vote are available to shareholders at all times on the Vonovia website.

Based on positive experience in recent years, Vonovia made use of the option provided by law of holding the 2024 Annual General Meeting as a virtual event, in line with the resolution passed by the 2023 Annual General Meeting. As stated in the grounds for the authorization for a virtual Annual General Meeting for a limited period of two years, the decision on an intercompany agreement with Deutsche Wohnen SE was presented to the shareholders at an in-person Annual General Meeting held in January 2025.

Remuneration Paid to Executive Bodies: In line with the German Stock Corporation Act and the GCGC, the Supervisory Board presented the amended remuneration system it had adopted for the Management Board members to the 2024 Annual General Meeting for approval, which was not granted, with only 40.41% of the votes cast in favor. A revised remuneration system is set to be presented to the 2025 Annual General Meeting.

The Management Board presented the remuneration report to the 2024 Annual General Meeting. The remuneration report for the 2023 fiscal year, which was audited by the auditor, was approved by 58.31% of the votes cast before being published on Vonovia SE’s website.

The remuneration system of the Supervisory Board of Vonovia SE is governed by the Articles of Association. It was confirmed by a 99.34% majority by the 2021 Annual General Meeting in accordance with the statutory requirements.

The Supervisory Board appoints, supervises and advises the Management Board and is directly involved in decisions of fundamental importance to the company. The Supervisory Board performs its work in accordance with the legal provisions, the Articles of Association, its rules of procedure and its resolutions. It consists of ten members, with terms of office ranging from one to four years.

The Supervisory Board examines and adopts the annual financial statements and the combined management report, which also includes the Non-financial Group Declaration. It assesses and confirms the proposal for the appropriation of profit as well as the consolidated financial statements and the combined management report on the basis of the report prepared by the Audit Committee. The Supervisory Board reports in writing to the shareholders at the Annual General Meeting on the result of its examination.

The Chair of the Supervisory Board is an independent member. The same applies to the chairs of the committees which the Supervisory Board has set up.

The Chairwoman of the Supervisory Board chairs the meetings and coordinates communications. The members of the Supervisory Board generally have the same rights and obligations. Supervisory Board resolutions are above all passed in the Supervisory Board meetings but also, if necessary, using the written procedure or by other communication means. At least two meetings are held every six months. In addition, if necessary and on the basis of the rules of procedure of the Supervisory Board, a meeting of the Supervisory Board or its committees can be convened at any time at the request of a member or the Management Board.

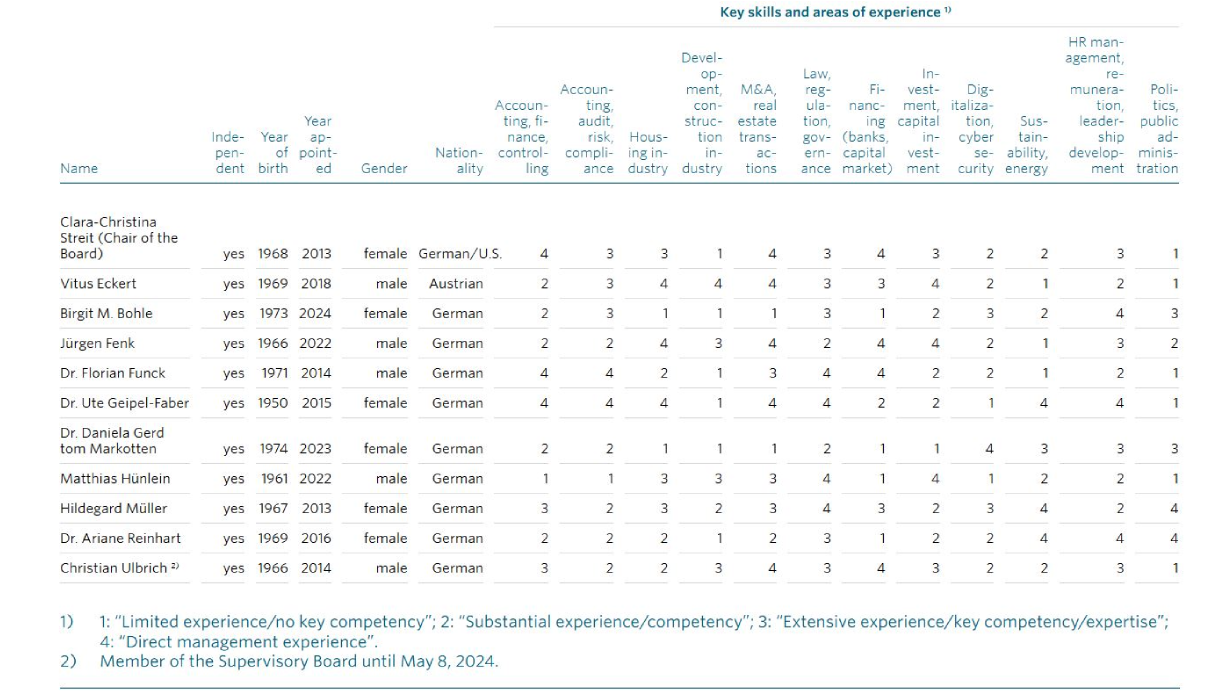

The Supervisory Board is composed in such a way that its members as a group have the knowledge, ability and specialist experience, also in those sustainability matters that are significant to the company, required to properly complete its tasks. All members are familiar with the real estate sector as the segment in which the company operates. At least one member of the Supervisory Board has expertise in the field of accounting and another member has expertise in the field of auditing.

Each Supervisory Board member shall ensure that they have enough time to carry out their mandate.

At the time at which this declaration was prepared, no Supervisory Board members exercised directorships or advisory tasks for important competitors of the company (see Conflicts of Interest).

Since 2020, a standard process for related party transactions has been firmly established within the company. This includes reporting on a regular basis to the Annual General Meeting as part of the Supervisory Board report. The Supervisory Board receives information twice a year in the compliance report on the analysis of related party transactions in accordance with the German Stock Corporation Act recorded by Group Accounting. Members of the Supervisory Board, for their part, immediately report any transactions that they or parties related to them conclude with the company. The relevant data is also collected at the end of the fiscal year. In the event that a transaction is subject to approval, the Supervisory Board has decided that the Governance and Nomination Committee is to decide on such approval in the future. Before any relevant transactions are addressed, checks are performed to ensure the due and proper composition of the committee. Once again, no such transactions were recorded in this reporting period.

The Supervisory Board performs annual effectiveness reviews as self-evaluations to reflect on, and optimize, its own work at regular intervals. A more extensive review is carried out every three years with support from an experienced and certified external consultancy firm. This detailed evaluation includes individual interviews with the Supervisory Board members and interviews with the members of the Management Board. The process also involves an initial and a final presentation by the consultant in order to communicate the findings and recommendations in a structured manner. Targeted measures are developed based on the findings in order to make the Supervisory Board even more effective. In the other years, the Supervisory Board also conducts an effectiveness review involving the external consultant, the only difference in terms of scope being that individual interviews and interviews with the Management Board members are only conducted as required, and that the external consultant does not make a final presentation. While the Supervisory Board conducted a comprehensive effectiveness review in 2023, the reduced effectiveness review was conducted in the form of a self-evaluation in 2024, with the support of the external consultant. The Supervisory Board received confirmation that the effectiveness of its work is above-average virtually across the board (see Report of the Supervisory Board). The review did not reveal any fundamental need for changes.

After the 2023 Annual General Meeting, the Supervisory Board reorganized the structure of its work in the committees, creating four committees from among its members: the Governance and Nomination Committee, the HR and Remuneration Committee, the Audit, Risk and Compliance Committee, and the Strategy, Finance and Sustainability Committee. Additional committees are formed as needed. Committees are made up of at least three members of the Supervisory Board (see Report of the Supervisory Board). The committees prepare topics to be discussed or resolved by the Supervisory Board. In addition, they pass resolutions on behalf of the entire Supervisory Board. The basis for committee work was the delegation of tasks and responsibilities within the scope of statutory requirements.

The HR and Remuneration Committee is made up of the Chair of the Supervisory Board or her deputy and at least two other members to be elected by the Supervisory Board. The Chair of the HR and Remuneration Committee is chosen by the committee members. In particular, this committee is responsible for the preparation of discussions and resolutions on the remuneration system and HR strategy, as well as other Management Board matters.

The Governance and Nomination Committee is made up of the Chair of the Supervisory Board and at least two other members to be elected by the Supervisory Board. The Chair of the Supervisory Board is the Chair of the Governance and Nomination Committee. The tasks of this committee are, in particular, to discuss the Declaration of Conformity and succession planning, to prepare the appointment of Management Board members and propose candidates for election as Supervisory Board members, to assign responsibilities and to decide in cases of legal, including loan, transactions with members of the Management Board and conflicts of interest.

The Supervisory Board appoints one of the members of the Audit, Risk and Compliance Committee as the Chair of the Committee. When electing the committee members, the Supervisory Board shall ensure that the Chair of the Audit Committee has specialist knowledge and experience in the application of accounting principles and internal control and risk management systems and/or in audits. The Committee Chair should be independent and not be a former member of the company’s Management Board whose appointment ended less than two years before their appointment as Chair of the Audit Committee. The Supervisory Board Chair should not be the Chair of the Audit Committee. As a result of the FISG provisions, one committee member must have experience in accounting and the other in auditing. With Dr. Florian Funck, as Chief Financial Officer of Sartorius AG, and Vitus Eckert, a long-standing chairman of supervisory and administrative boards at international companies, the Audit Committee has members with the requisite expertise in the fields of accounting and auditing (see table entitled Supervisory Board Qualifications Profile). The Audit, Risk and Compliance Committee handles, in particular, the monitoring of the accounting process, the effectiveness of the internal control system, risk management system and internal audit system, the audit of the annual financial statements and compliance. Accounting and auditing also include the sustainability report and the auditing of this report. Each member of the Audit, Risk and Compliance Committee can obtain information directly from the heads of those central departments that are relevant to the Audit Committee via the Committee’s Chair.

In place of the Supervisory Board, the Audit, Risk and Compliance Committee adopts resolutions approving the handling of currency risks, interest, liquidity and other financial risks, the handling of credit risks and the implementation of external financing principles.

The Audit, Risk and Compliance Committee prepares the resolutions of the Supervisory Board on the annual financial statements (and, if applicable, the consolidated financial statements), and, in place of the Supervisory Board, reaches the agreements with the auditor (in particular the issuing of the audit mandate to the auditor, the determination of strategic audit objectives and the fee agreement). The Committee takes suitable action to assess and monitor the independence of the auditor and the audit quality and is responsible for discussing the assessment of the audit risk, audit strategy, planning and results with the auditor. The Audit, Risk and Compliance Committee also makes decisions on behalf of the Supervisory Board on the approval of contracts with auditors for non-assurance services.

The Strategy, Finance and Sustainability Committee is made up of the Chair of the Supervisory Board or her deputy and at least two other members to be elected by the Supervisory Board. The Chair of the Strategy, Finance and Sustainability Committee is chosen by the committee members. The Committee discusses focal issues relating to corporate strategy, financial matters and sustainability issues, and prepares resolutions for the Supervisory Board. It advises and monitors the Management Board with regard to its sustainability strategy, in particular the planning of the strategic framework for all Group-wide sustainability measures, including the interaction between entrepreneurial activities and the challenges associated with climate change. The support provided to the Supervisory Board and Management Board also includes the company’s digitalization principles, including technological innovation and transformation. The Strategy, Finance and Sustainability Committee prepares the resolutions of the Supervisory Board on the following matters:

In place of the Supervisory Board, the Finance Committee adopts resolutions in particular on general guidelines and principles for the implementation of the financial strategy, and also on important transactions regarding the acquisition and disposal of properties and shares in companies as well as corporate financing.

The Management Board members are jointly accountable for independently managing the company in the company’s best interests while complying with the applicable laws and regulations, the Articles of Association and the rules of procedure. In doing so, they must take the interests of the shareholders, the employees and other stakeholders into account.

The Management Board is monitored and advised by the Supervisory Board. It has adopted the rules of procedure in consultation with the Supervisory Board. The Management Board has a Chair who coordinates the work of the Management Board and represents it in dealings with the Supervisory Board.

The Management Board informs the Supervisory Board regularly, in due time and comprehensively in line with the principles of diligent and faithful accounting in accordance with the law and the reporting duties specified by the Supervisory Board.

The Management Board develops the company’s strategy, coordinates it with the Supervisory Board and implements it. It ensures that all statutory provisions and the company’s internal policies are complied with. The Management Board also ensures appropriate risk management and risk controlling in the company. The Chief Executive Officer is responsible for the social and environmental factors to be taken into account in this process, as well as for the associated risks, opportunities and impacts.

The CEO submits the corporate planning for the coming fiscal year to the Supervisory Board as well as the midterm and strategic planning, which also includes sustainability targets. The Chair of the Management Board informs the Supervisory Board Chair without delay of important events that are essential for the assessment of the situation and the development of the company or for the management of the company as well as of any shortcomings that occur in the monitoring systems.

Management Board decisions require the approval of the Supervisory Board for certain important transactions. Transactions and measures that require Supervisory Board approval are submitted in good time to the Supervisory Board, or to one of its committees where particular powers are delegated to them. The Management Board members are obliged to disclose any conflicts of interest to the Supervisory Board without delay and to inform the other Management Board members accordingly.

The Management Board members are subject to a comprehensive non-competition obligation. Management Board members may only take up sideline activities, in particular positions on supervisory boards in companies outside the Group, with the approval of the Supervisory Board.

Important transactions between the company, on the one hand, and the Management Board members as well as persons they are close to or companies they have a personal association with, on the other, require the approval of the Supervisory Board. The internal procedure put in place by the Supervisory Board to evaluate these transactions is set out in the section entitled “The Supervisory Board”.

In accordance with the German Corporate Governance Code, the Supervisory Board and the Management Board must be composed in such a way that these bodies/their members as a group have the knowledge, ability and specialist experience required to properly complete their tasks. The requirements were extended and set out by law with the entry into force of the CSR Directive Implementation Act. The Supervisory Board has adopted the following criteria and objectives for recruiting individuals to the Management and Supervisory Boards, taking the above-mentioned requirements into account:

Composition: As a listed company that is not subject to codetermination, the Supervisory Board of Vonovia SE is to include ten members, an appropriate number of whom are to be independent within the meaning of the Code. All members should have sufficient time available to perform the duties associated with their mandate with due regularity and care.

When proposing candidates to fill new Supervisory Board positions to the Annual General Meeting, the Supervisory Board should have performed an extensive review to ensure that the candidates standing for election meet the corresponding professional and personal requirements (see table entitled Supervisory Board Qualifications Profile) and must disclose the candidates’ personal and business-related relationships with the company, the governing bodies of the company and any shareholders with a material interest in the company. Shareholders are deemed to hold a material interest if they hold more than 10% of the voting shares in the company, either directly or indirectly. The proposals are not based on the candidate’s affiliation to any particular party that is interested in the company.

Other general criteria, and criteria defined in the GCGC that applied in the fiscal year under review, governing composition include:

Skills profile: The Supervisory Board of Vonovia SE should be composed so as to ensure qualified supervision of, and provision of advice to, the Management Board. The candidates nominated for election to the Supervisory Board should be able, on the basis of their knowledge, skills and professional experience, to perform the duties of a Supervisory Board member of a listed real estate company that is active on the international capital market. In terms of their personality, the candidates nominated for election should show integrity, professionalism and commitment. The aim is to ensure that the Supervisory Board as a whole offers all of the knowledge and experience that the Group considers to be important for ensuring Vonovia’s operational and financial further development, also from a sustainability perspective.

Independence: The Supervisory Board shall only include members that it considers to be independent. Material conflicts of interest that are not merely of a temporary nature, e.g., arising from functions on executive bodies or advisory roles performed at the company’s major competitors, should be avoided. A Supervisory Board member is, in particular, not to be considered independent if they have personal or business relations with the company, its bodies, a controlling shareholder or a company associated with such a shareholder that may cause a substantial and not merely temporary conflict of interest.

Diversity: When nominating candidates for election, the Supervisory Board should also take diversity into account. In accordance with the German Act on the Equal Participation of Women and Men in Leadership Positions in the Private Sector and the Public Sector (Gesetz für die gleichberechtigte Teilhabe von Frauen und Männern an Führungspositionen in Privatwirtschaft und im öffentlichen Dienst), the Supervisory Board should comprise at least 30% women and 30% men. Vonovia intends for the Nomination Committee to continue to have at least one female member. Vonovia’s Supervisory Board should meet both criteria in the current target period leading up to the end of 2026. When assessing potential candidates for reelection or to fill a Supervisory Board position that has become vacant, qualified women are to be included in the selection process and given appropriate consideration when the nominations are made.

Target achievement: The current composition of the Supervisory Board is consistent with the skills profile and the composition targets set for the Supervisory Board. The members of Vonovia SE’s Supervisory Board more than meet the requirements in terms of their specialist qualifications, professional knowledge and experience. The members of the Supervisory Board as a whole are familiar with the industry and the specific features of the business, and have the relevant functional experience. The requirements regarding diversity (at least 30 % women; at least 30 % men; at least one woman should be a member of the Nomination Committee) are more than met. With Clara Christina Streit (member of supervisory and advisory boards of German and international companies), Birgit M. Bohle (member of the Management Board of Deutsche Telekom AG), Dr. Ute Geipel-Faber (member of German supervisory boards and international advisory boards), Dr. Daniela Gerd tom Markotten (member of the Management Board of Deutsche Bahn AG), Hildegard Müller (President of the German Association of the Automotive Industry) and Dr. Ariane Reinhart (member of the Management Board of Continental AG), women make up 60 % of the Supervisory Board. Clara Christina Streit and Dr. Ariane Reinhart are members of the Governance and Nomination Committee.

As well as meeting the diversity requirements, as highlighted above, the election of Birgit M. Bohle has also provided a significant boost in terms of the Supervisory Board’s skills, particularly in the areas of strategy, international management, digitalization, legal and sustainability. As such, the current composition ensures that the Supervisory Board covers all of the necessary skills. At the Supervisory Board meetings in 2025, succession planning for 2025 and 2026 will continue based on the company’s strategic objectives, and proposals will be drawn up with external support.

All ten members of the Supervisory Board are considered by the company to be independent within the meaning of C. 6 and C. 7 of the GCGC. No member of the Supervisory Board was a member of the company’s Management Board or has a personal relationship with a significant competitor of the company as defined by C. 12 of the GCGC. The Chair of the Audit, Risk and Compliance Committee is an expert in the fields of auditing and accounting. The main knowledge, skills and professional experience of the Supervisory Board members are summarized in the table below.

Composition: In accordance with the Articles of Association, the Management Board of Vonovia SE consists of at least two members. The Supervisory Board appoints the Management Board members in accordance with the Articles of Association and the law. The Supervisory Board can appoint a Chair of the Management Board and a Deputy Chair of the Management Board. The decisions made by the Supervisory Board on the composition of the Management Board should be based on a careful analysis of the existing and future challenges facing the company. The Management Board of Vonovia SE should be composed so as to ensure that, as the management body, it can perform the duties set out above reliably and in full. When taken as a whole, it should combine all of the knowledge and experience required to ensure that the Group can pursue its operational and financial objectives in an effective and sustainable manner in the interests of the shareholders and other stakeholders. While membership of the Management Board is not limited to a certain period of time, the contract of employment of a Management Board member ends when the member turns 67 at the latest.

Skills profile: Newly appointed Management Board members should be able, on the basis of their knowledge, skills and professional experience, to reliably perform the duties assigned to them in a listed real estate company that is active on the international capital market. In addition to having good professional and fundamental general qualifications, they should also show integrity, professionalism and commitment.

Independence: The Management Board should perform its management duties in a manner that is free of any conflicts of interest. Functions on executive bodies or advisory roles performed at major competitors of the company should be avoided.

Diversity: When looking for candidates to fill a Management Board position that has become vacant, the Supervisory Board should include qualified women in the selection process and give them appropriate consideration. Gender should be irrelevant when it comes to filling Management Board positions. The Supervisory Board has adopted a target of at least 20% women on the Management Board for the current period, which is set to run until December 31, 2026. For the two levels of management below the Management Board, the target for the proportion of women is 30%, to be achieved by December 31, 2026.

Target achievement: The objectives regarding the composition of the Management Board set out above have been met in full. The Management Board consists of one female and four male members who are able to manage the Group appropriately on the basis of their experience and skills. At the end of the reporting year, the first two levels of management below Vonovia’s Management Board comprise 25.8% women, an increase of 1.6 percentage points against the previous year. Achieving the target of 30% women by December 31, 2026, for both management levels will continue to require even more systematic succession planning in order to actively support women and open up opportunities for them to assume technical management roles against the backdrop of the planned expansion of technical services at Vonovia. In Germany, three new programs were launched for the first time, with up to 200 female participants, to promote equality of opportunity in the reporting year: the Women’s Network, the Female Leadership Forum and a mentoring program for high-potential women. These measures to promote career advancement for women are designed as an ongoing and continuous process in which each program is developed over the long term in line with the prevailing circumstances.

The Supervisory Board addresses short-term and long-term succession planning for the Management Board and Supervisory Board on an ongoing basis. The Governance and Nomination Committee of the Supervisory Board with a specialized personnel consultancy firm compiled a list of candidates for possible replacement appointments to both committees. The listings of potential candidates will be maintained on an ongoing basis to enable well-founded succession planning. Candidates are selected based on the targets for board composition and the defined skills profile – possible optimization is taken into account in succession planning. Succession planning results in processes and appointments that bring sustainable improvements in collaboration.

With the support of external consultants, the Governance and Nomination Committee has drawn up a list of possible candidates for the Supervisory Board, taking into account the strategic objectives for the composition of the Supervisory Board based on the updated skills profile and diversity requirements. This committee also prepares the list of candidates for election to the full Supervisory Board to be presented to the Annual General Meeting.

Succession planning for the Management Board is a systematic process that is based on the Group’s strategic objectives and future challenges. A skills profile has been prepared for each executive division of the Management Board. Taking this as a basis, an extensive overview of suitable candidates, split into categories depending on when they are expected to be available, was compiled with external support. These profiles will be used to benchmark current position holders and potential in-house succession options.

The Management and Supervisory Boards vote on the strategic direction of the company and discuss the current status of implementation of the corporate strategy, which also includes sustainability topics (see Strategy) at regular intervals. Furthermore, the Management Board regularly informs the Supervisory Board in written or verbal reports of topics including the development of business and the situation of the company. In this way, the Supervisory Board receives detailed documents from the Management Board regularly and in a timely manner on the economic development and the company’s current situation as well as the half-yearly risk management and compliance reports that deal with the most important risks for the business as well as compliance management at Vonovia SE. On the basis of these reports, the Supervisory Board monitors the company’s management by the Management Board as well as via its committees where particular powers are delegated to these committees. The Supervisory Board holds discussions without Management Board members being present at all of its meetings. In the reporting year, this was implemented at the end of each Supervisory Board meeting. At meetings of the HR and Remuneration Committee and the Governance and Nomination Committee, Management Board members are never present during the discussions by the Supervisory Board members. For information on the remuneration agreements that reflect this cooperation, please refer to the Remuneration Report.

In the reporting year, there were no conflicts of interest of Management Board or Supervisory Board members, which are to be reported immediately to the Supervisory Board. There was no need to discuss or make decisions on legal matters, in particular lending transactions with members of executive bodies or individuals related to them.

The Annual General Meeting selected PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschaft as auditor for the annual financial statements and consolidated financial statements

We prepare the annual financial statements of Vonovia SE in accordance with the German Commercial Code (HGB) and the German Stock Corporation Act (AktG) in conjunction with Article 5 SE Regulation and the consolidated financial statements in accordance with the International Financial Reporting Standards (IFRS) to be applied in the EU. In addition, we prepare a combined management report as required by the German Commercial Code (HGB) and the German Stock Corporation Act (AktG).

The Management Board is responsible for financial accounting. The Supervisory Board examines and adopts or approves the annual financial statements, the consolidated financial statements and the combined management report.

In addition to our annual financial statements, we also prepare interim statements for the first and third quarters as well as an interim financial report for the first half-year in accordance with the German Securities Trading Act.

Both the interim statements and the interim financial report are presented to, and discussed with, the Audit Committee of the Supervisory Board before they are published.

Under German stock corporation and commercial law, there are special requirements for internal risk management that apply to Vonovia. Therefore, our risk management system covers risk inventory, analysis, handling and limitation. In accordance with Section 317 (4) of the German Commercial Code (HGB) applicable to listed companies, PricewaterhouseCoopers assesses in its audit the risk early warning system as part of the risk management system. Furthermore, we maintain standard documentation of all our internal control mechanisms throughout the Group and continually evaluate their effectiveness.

In the combined management report, we provide comprehensive information on the main features of the internal control and risk management system with regard to the accounting process and the Group accounting process in accordance with our reporting duties pursuant to Sections 289 (4) and 315 (4) of the German Commercial Code (HGB).

Pursuant to Section 315b of the German Commercial Code (HGB), the Management Board is obliged to submit a Non-financial Group Declaration, which in turn has to be reviewed by the Supervisory Board. The Supervisory Board has commissioned the auditor to perform the review (see Report of the Supervisory Board).

| Corporate Governance | Format |

|---|---|

| Corporate Governance Declaration 2023 | Download PDF, 91.6 KB |

| Corporate Governance Declaration 2022 | Download PDF, 94 KB |

| Corporate Governance Declaration 2021 | Download PDF, 94.2 KB |

| Corporate Governance Declaration 2020 | Download PDF, 90.6 KB |

| Corporate Governance Declaration 2019 | Download PDF, 95.8 KB |

| Corporate Governance Declaration 2018 | Download PDF, 96.86 KB |

| Corporate Governance Declaration 2017 | Download PDF, 96.04 KB |